CARES ACT: Stimulus Checks

WHO WILL RECEIVE A CHECK?

- Individuals whose income are within the required threshold

- Individuals with children under the age of 17 years old

- Individuals receiving social security (SSN)

- Individuals with green cards H-1B or H-2A visas

- Expatriates with social security numbers and file taxes in the US.

- Disabled individuals who receive SSA or Veteran (receive SSA 1099 or RRB-1099) – do not have to file tax return (cannot be claimed as a dependent)

- Individuals who do not have to file taxes due to income falling below $12,200 for singles or $24,400 for couples.

DETERMINING FACTORS:

- Tax Returns for 2018/2019: If taxes were filed for the previous year (2019), the IRS will use that information to determine the amount of your check. If taxes were not yet filed for 2019, your stimulus check amount will be based on your 2018 status.

Single: $1,200 Married Filing Joint (MFJ): $2,400 Head of Household (HH): $1,200

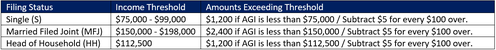

- Income Thresholds: Based on your Adjusted Gross Income (AGI) reflected on taxes

Households with an AGI that exceeds the minimum threshold will have $5 subtracted for every $100. For example: A single household without an AGI of $76,000 will have $50 subtracted from its check. The amount received will be $1,150. If the AGI exceeds $99,000, a stimulus check will not be given.

- Dependents: $500 for every child under the age of 17 years old

WHO DOES NOT GET A CHECK:

- Individuals over the income threshold

- Children or anyone claimed as a dependent

- Individuals without SSN (ITIN does not qualify; temporary workers, illegal immigrants)

- Disabled adults claimed as dependents

- Seniors claimed as dependents

- Individuals behind on child support – will either receive a partial check or no check at all.

IMPORTANT INFORMATION:

- Refund will not be taxed and there is no clawback (will not be asked to pay back funds)

- Funds will be sent via Direct Deposit or Check Mailed

- Direct Deposit: if direct deposit or debit was used when taxes were filed, stimulus check will be direct deposited and received by April 20th.

- Checks Mailed: if tax refund or tax owed was mailed, a check will be mailed between May and September.

- Split Custody: Whoever claimed the child(ren) last

- Recently Divorced or Estranged: last address or account on file will receive $2,400 direct deposit or check mailed.

- Scams & Hoax: Avoid anyone or organization charging for a quick turnaround to receive stimulus check

- Direct Deposit: if direct deposit or debit was used when taxes were filed, stimulus check will be direct deposited and received by April 20th.

- Checks Mailed: if tax refund or tax owed was mailed, a check will be mailed between May and September.